Risks and opportunities for the development of kinetic energy in the aluminum industry

Dong Xing

Dong Xing

2018-07-09 18:40:17

In 2017, China's electrolytic aluminum consumption was about 35.5 million tons, up 9.1% year-on-year, higher than GDP growth rate. The macro demand structure of aluminum is also adjusted with the economic structure. In 2017, investment, consumption and exports contributed about 50%, 38% and 12% respectively to aluminum.

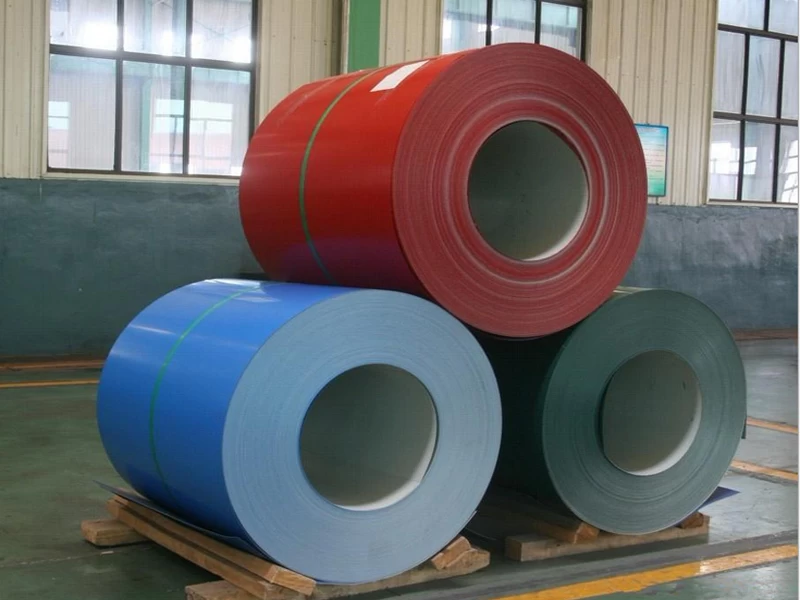

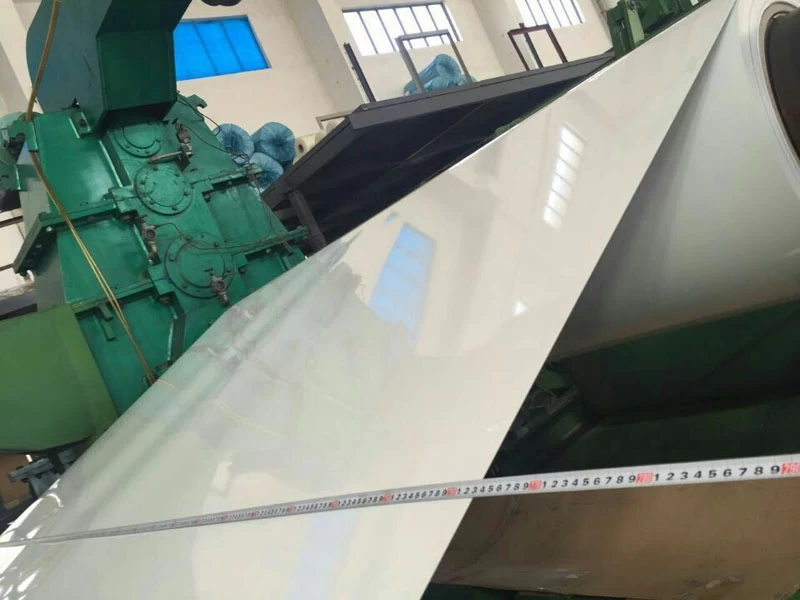

The overall demand maintained rapid growth. Specifically, the downstream industry is still the largest application area of aluminum in China, accounting for 33%. Compared with developed countries, the proportion of aluminum used in China's transportation industry is significantly lower. As the growth rate of the real estate industry tends to be stable, the future aluminum processing(Aluminum cladding coil manufacturer china) will be more oriented towards industrial profiles.

Although the real estate is regulated, but as a pillar-type industry in China, there will be no cliff-like decline in the short term, and downstream demand is still stable. As for the second largest industry in China: the automobile industry is undergoing a fundamental transformation. It may be a new kinetic energy to drive the growth of the aluminum industry.

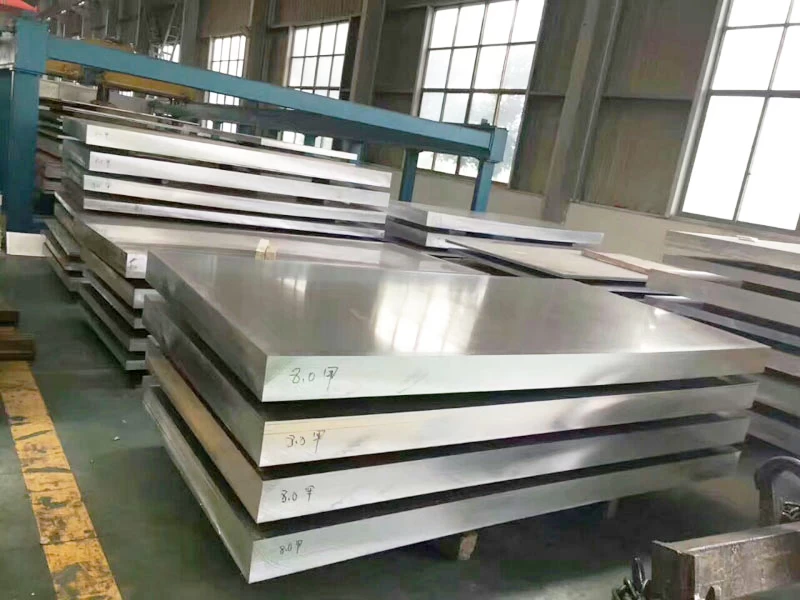

The use of aluminum in passenger cars and commercial vehicles is accelerating as it provides the fastest, safest, most environmentally friendly and cost-effective way to improve performance, improve fuel economy and reduce emissions while maintaining or improving safety. Sex and durability. Due to its advantages and environmental advantages, the Ford F-150 and other mass-market vehicles to Audi, Mercedes-Benz, Land Rover and other luxury models, aluminum is increasingly becoming the "preferred material" for automakers. According to the latest research from Ducker Worldwide, the aluminum content in cars will increase by 30% in the next decade.

The use of aluminum in passenger cars and commercial vehicles is accelerating as it provides the fastest, safest, most environmentally friendly and cost-effective way to improve performance, improve fuel economy and reduce emissions while maintaining or improving safety. Sex and durability. Due to its advantages and environmental advantages, the Ford F-150 and other mass-market vehicles to Audi, Mercedes-Benz, Land Rover and other luxury models, aluminum is increasingly becoming the "preferred material" for automakers. According to the latest research from Ducker Worldwide, the aluminum content in cars will increase by 30% in the next decade.

It can be foreseen that with the continuous promotion of new energy vehicles and the light weight of traditional vehicles in the future, the demand for aluminum for automobiles will show explosive growth, but the incremental demand brought about by the transformation of industrial structure is not only the automobile.

In the aviation sector, Boeing's global aircraft delivery volume was 763 in 2017, of which 202 new aircraft were delivered to Chinese airlines, accounting for 26%, and a new record, reflecting the continued strong demand for aircraft in the Chinese aviation market. On May 5, 2017, the domestic C919 large aircraft ushered in the first flight at Shanghai Pudong Airport, realizing another leapfrog development of China's aviation technology. It is foreseeable that the future supply chain of C919 will gradually be localized and drive the development of the entire industrial chain. At present, the proportion of aluminum alloy materials in civil aircraft fuselage materials is about 70%, and the market scale of aluminum alloy aviation materials will become larger and larger.

In the field of rail transit, the “Medium and Long-term Railway Network Plan” jointly prepared by the National Development and Reform Commission, the Ministry of Transport and the Railway Corporation was released in July 2016. The railway fixed assets investment will be stable at around 800 billion yuan. The investment in railway locomotives is about 800 billion yuan, with an annual average of 160 billion yuan. The further improvement of the future high-speed rail network will generate higher demand for high-speed rail vehicles. Therefore, the purchase of high-speed trains and other locomotives will continue to grow steadily. It is expected that the demand for high-performance aluminum alloy materials in the rail transit sector will maintain a relatively high growth rate.

The downstream demand for aluminum products is still strong, and the rise of new kinetic energy will accelerate the development of the entire industry.

The overall demand maintained rapid growth. Specifically, the downstream industry is still the largest application area of aluminum in China, accounting for 33%. Compared with developed countries, the proportion of aluminum used in China's transportation industry is significantly lower. As the growth rate of the real estate industry tends to be stable, the future aluminum processing(Aluminum cladding coil manufacturer china) will be more oriented towards industrial profiles.

Although the real estate is regulated, but as a pillar-type industry in China, there will be no cliff-like decline in the short term, and downstream demand is still stable. As for the second largest industry in China: the automobile industry is undergoing a fundamental transformation. It may be a new kinetic energy to drive the growth of the aluminum industry.

It can be foreseen that with the continuous promotion of new energy vehicles and the light weight of traditional vehicles in the future, the demand for aluminum for automobiles will show explosive growth, but the incremental demand brought about by the transformation of industrial structure is not only the automobile.

In the aviation sector, Boeing's global aircraft delivery volume was 763 in 2017, of which 202 new aircraft were delivered to Chinese airlines, accounting for 26%, and a new record, reflecting the continued strong demand for aircraft in the Chinese aviation market. On May 5, 2017, the domestic C919 large aircraft ushered in the first flight at Shanghai Pudong Airport, realizing another leapfrog development of China's aviation technology. It is foreseeable that the future supply chain of C919 will gradually be localized and drive the development of the entire industrial chain. At present, the proportion of aluminum alloy materials in civil aircraft fuselage materials is about 70%, and the market scale of aluminum alloy aviation materials will become larger and larger.

In the field of rail transit, the “Medium and Long-term Railway Network Plan” jointly prepared by the National Development and Reform Commission, the Ministry of Transport and the Railway Corporation was released in July 2016. The railway fixed assets investment will be stable at around 800 billion yuan. The investment in railway locomotives is about 800 billion yuan, with an annual average of 160 billion yuan. The further improvement of the future high-speed rail network will generate higher demand for high-speed rail vehicles. Therefore, the purchase of high-speed trains and other locomotives will continue to grow steadily. It is expected that the demand for high-performance aluminum alloy materials in the rail transit sector will maintain a relatively high growth rate.

The downstream demand for aluminum products is still strong, and the rise of new kinetic energy will accelerate the development of the entire industry.